National Bank of Pakistan NBP jobs advertisement dated about 19 August 2024 in daily Jang Newspaper invites applications for the vacant posts of Officer Cash Management, Foreign Exchange Settlement Officer, Officer Salary Processing, Remittance Officer and Officer Money Market Operations in Karachi, Sindh Pakistan. Bachelor, MS and Master etc. educational qualification will be preferred.

The latest Management jobs and other Government jobs in the National Bank of Pakistan NBP closing date is around August 28, 2024.

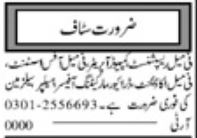

National Bank of Pakistan Jobs – NBP Jobs in Karachi

Online Applicants: Be among the first 25 applicants

Date Posted/Updated: 19 August, 2024

Category/Sector: Government

Newspaper: Jang Jobs

Education: Bachelor | Master | MS | BS

Vacancy Location: Karachi, Sindh, Pakistan

Organization: National Bank of Pakistan NBP

Job Industry: Management Jobs

Job Type: Full Time

Expected Last Date: 28 August 2024 or as per paper ad

Available Positions for National Bank Of Pakistan Jobs:

- Officer-Money Market Operations (OG-II/OG-1)

- Foreign Exchange Settlement Officer (OG-II/OG-I)

- Centralized Remittances (OG-II/OG-I)

- Officer Cash Management, Operations (OG-III/OG-II)

- Salary Processing, Cash Management Operations (OG-III/OG-II)

Detail of Each Position of National Bank Of Pakistan Jobs:

1. Officer-Money Market Operations (OG-II/OG-1)

Reporting to:

- Unit Head-Money Market Operations

Educational/ Professional Qualification:

- Minimum Graduation or equivalent from a local or international university/college/institute recognized by the HEC

- Candidates having a Master’s degree and relevant diploma/ certification(s) will be preferred

Experience:

- Minimum 03 years of banking experience in Money Market Operations

Other Skills/Expertise:

- Strong knowledge of money market instruments, regulations and banking products

- Attention to detail and ability to work independently

- Proficient in using Treasury Management Systems

- Proficient in MS Office suite (Word, Outlook, PowerPoint and Excel)

- Good communication and interpersonal skills

Outline of Main Duties /Responsibilities:

- To ensure timely settlement of outright deals, including Interbank and Investor Portfolio Securities (PS) deals

- To ensure timely settlement of Interbank Repo/Reverse Repo/Call deals To settle State Bank of Pakistan (SBP) reporting on a daily, weekly, and monthly basis

- To ensure IPS account opening and maintenance

- To submit claims to the State Bank of Pakistan (SBP) for redemption and coupon payment of NBP’s account and IPS account

- To perform daily reconciliation of money market accounts and resolve discrepancies

- Ensure all transactions comply with regulatory requirements and internal policies

- Coordinate with internal and external auditors for the timely completion of audit work

- To ensure daily checking of reports from the previous working day and verifying all money market accounting entries

- To handle and arrange all requirements of internal, external, and State Bank of Pakistan (SBP) audits

- To ensure submission of Money Market Computerized Reporting System (MMCRS) data daily to the State Bank of Pakistan (SBP)

- To address audit comments (internal & external), implement measures to minimize and curtail recurrence

- To perform any other assignment as assigned by the supervisor)

2. Foreign Exchange Settlement Officer (OG-II/OG-I)

Reporting to:

- Unit Head-Foreign Exchange Operations

Educational/Professional Qualification:

- Minimum Graduation or equivalent from a local or international university/college/institute recognized by the HEC

- Candidates having a Master’s degree or relevant diploma/ certification(s) will be preferred

Experience:

- Minimum 03 years of banking experience in Foreign Exchange Operations

Other Skills/Expertise:

- Sound knowledge of treasury and exchange-related products

- Proficient in MS Office suite (Word, Outlook, PowerPoint and Excel)

- Good communication (both verbal & written) and interpersonal skills

- Provide in-depth analysis of the foreign exchange market and global interest rates

Outline of Main Duties /Responsibilities:

- To ensure timely processing of all foreign exchange transactions within specified timeframes

- To adhere to internal policies, procedures, and exchange regulations while processing foreign exchange deals

- To verify and process SWIFT messages related to foreign Inter-Bank deals accurately

- To facilitate the timely settlement of PKR against foreign exchange. transactions through RTGS

- To manage the State Bank of Pakistan’s cash reserve requirements

- To ensure timely settlement of compensation claims with counterpart

- banks

- To coordinate with the treasury front office in case of any discrepancy 7 deal amendments and cancellation

- To coordinate with the reconciliation department to resolve outstanding entries in Nostros accounts

- To reconcile foreign exchange operations books in case of variance and trace out the difference for the rectification

- To conduct monthly reconciliations of outstanding foreign exchange transactions

- To monitor daily foreign exchange profit reports and rectify variances promptly

- To ensure timely processing of all treasury transactions within specified timeframes

- To perform any other assignment as assigned by the supervisor(s)

3. Centralized Remittances (OG-II/OG-I)

Reporting to:

- Unit Head-Remittance Scrutiny & MIS Reporting/Unit Head – Inward Remittance Processing/Unit Head-Outward Remittance Processing

Educational/Professional Qualification:

- Minimum Graduation or equivalent from a local or international university/college/institute recognized by the HEC

- Candidates having a Master’s degree or relevant diploma/ certification(s) will be preferred

Experience:

- Minimum 03 years of experience in Foreign Exchange Centralized Remittances and Payment Services related areas

Other Skills/Expertise/Knowledge Required:

- Knowledge of relevant SBP regulations

- Operational knowledge of SWIFT system and SWIFT messaging

- Understanding of the processing cycle of Foreign Centralized Remittance

- Good communication and interpersonal skills

- Good Knowledge of ITRS

Outline of Main Duties/Responsibilities:

- To process all inward commercial remittance requests received from SWIFT ensuring compliance with the Bank’s policies and all prevailing SBP regulations

- Coordinate with branches for submission of required documents under the SBP Foreign Exchange manual and Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) guidelines

- Coordinate between different units to obtain required information and responses on a timely basis

- To refer back discrepant cases to respective branches on time and follow up for re-submission after rectification

- To monitor daily complaints about remittances and coordinate with respective branch staff and complaint management team for timely resolution

- To ensure transactions’ due diligence through scrutiny of necessary documents and customer profile

- To manage complaint/ query handling/ amendment & cancellation requests with Foreign Banks

- To provide an acknowledged copy of transmitted SWIFT message to the branches after receipt from SWIFT OPS

- To receive requests and documents from the branches and maintain MIS To maintain and execute ITRS reporting as per prevailing SBP rules and regulations

- To perform other assignments as assigned by the supervisor(s)

4. Officer Cash Management, Operations (OG-III/OG-II)

Reporting to:

- Unit Head-Payments Cash Management, Unit Head – Collections Cash Management

Educational/Professional Qualification:

- Minimum Graduation or equivalent from a local or international university/college/institute recognized by the HEC

- Candidates having a Master’s degree and/or relevant diploma/certification (s) will be preferred

Experience:

- Minimum 01 years of banking experience in Cash Management Operations

Other Skills/Expertise /Knowledge Required:

- Knowledge of cash management collection/payment products and customer onboarding in the system

- Ability to work independently and meet deadlines

- Proficient in MS Office (Word, Outlook, PowerPoint and Excel)

- Good communication and analytical skills

- Good customer service orientation

Outline of Main Duties /Responsibilities:

- To ensure that customer collections are timely processed at the branch counter and credited to the client’s account correctly in the given TAT To ensure customer’s payments are timely/correctly processed by validating the client’s data in the given TAT

- To prepare and maintain records/files of cash management payments and collections mandates with a good understanding of operational process as per Prudential Regulations

- To do daily account(s) reconciliation and funding of collections & payments business

- To implement collections and payments mandates in the system as well as rolling it out across branch networks and providing solutions to customers in close coordination with branches and customers

- To support and resolve customer inquiries by coordinating with relevant stakeholders under the SOPs to avoid discrepancies as per Prudential Regulations

- To ensure that the highest professional standards of customer services are provided to NBP’s customers with an end to secure both new business and to deepen the existing business relationships

- To assist customers to understand the benefits of products and services for cash management

- To maintain confidentiality and integrity of customer information To collaborate with team members and ensure compliance with regulations and reporting requirements

- To suggest standardized procedures and improve efficiency in collection and payment processes

- To achieve the Key Performance Indicators (KPIs) assigned in terms of Cash Management Operations

- To maintain accounts and transactions as per Turnaround Time (TAT) To perform BCP exercises and prepare required documentation as advised from time to time by the senior management. Preparing and guiding team members for any BCP situations

- To perform UAT of new product initiatives

- To perform any other assignment as assigned by the supervisor(s)

5. Salary Processing, Cash Management Operations (OG-III/OG-II)

Reporting to:

- Unit Head-Salary Processing

Educational/Professional Qualification:

- Minimum Graduation or equivalent from a local or international university/college/institute recognized by the HEC

- Candidates having a Master’s degree and/or relevant diploma certification(s) will be preferred

Experience:

- Minimum 01 years of banking experience in Cash Management Operations, preferably in handling Corporate and government bulk Payroll Departments

Other Skills/Expertise /Knowledge Required:

- Proven experience in Cash Management or Banking Operations

- Knowledge of salary processing

- Strong attention to detail and accuracy

- Good communication and analytical skills

- Ability to work independently & meet deadlines

- Proficiency in using bulk payroll systems & MS Excel

Outline of Main Duties /Responsibilities:

- To maintain bulk payroll (Corporate / Government) information by collecting and entering data

- To update bulk payroll information/records from the available data To resolve bulk payroll discrepancies (if any)

- To manage the entire bulk payroll on behalf of the bank, including overseeing and processing payroll

- To prepare bulk payroll reports for management on a daily / fortnightly and monthly basis

- To maintain confidentiality and integrity of employee bulk payroll information

- To conduct the Bank’s bulk reconciliations and ensure proper documentation of financial activities

- To collaborate with team members and ensure compliance with regulations and reporting requirements

- To suggest standardized procedures and improve efficiency in bulk payroll processing

- To perform UAT of new product initiatives

- To perform any other assignment as assigned by the supervisors

Assessment Test/ Interview(s) for National Bank Of Pakistan Jobs:

Only shortlisted candidates strictly meeting the above-mentioned basic eligibility criteria will be invited for test and/or panel interview(s).

Employment Type:

The employment will be on a contractual basis, for three years which may be renewed at the discretion of the Management. Selected candidates will be offered a compensation package and other benefits as per the Bank’s policy/rules.

Other Information for National Bank Of Pakistan Jobs:

- Interested candidates may visit the website www.sidathyder.com.pk/careers and apply online within 10 working days from the date of publication of this advertisement as per the given instructions.

- Applications received after the due date will not be considered in any case.

- No TA/DA will be admissible for the interview.

- National Bank of Pakistan is an equal opportunity employer and welcomes applications from all qualified individuals, regardless of gender, religion, or disability.

Apply for More Jobs: Chaplet International Lahore

- Create your resume and cover letter, Modify your resume and cover letter for each job accordingly by highlighting relevant experiences.

- Do not forget to use the key points of the expected job.

- Read the complete ad online to know how to apply for the latest Talagang International Overseas Employment Promoters job opportunities.

Special Note:

Todaysmagz job posts are compiled from leading Pakistani newspapers such as Express, Daily Jang, Nawa-i-Waqt, and Nation.

We aim to facilitate job seekers from different cities of Pakistan such as Islamabad, Rawalpindi, Peshawar, Lahore, and Karachi.